- You will save time. It's much quicker to get your documents to us via Receipt Bank, as using the mobile app or forwarding an email will only take you seconds to do, especially if you are currently posting or dropping these documents off. Since you are submitting your documents to Receipt Bank straight away, there is also far less chance of any being lost.

- You no longer have to keep your paper documents, meaning you can have a paperless office or home. It is also much faster to find a particular document using the Receipt Bank archive and advanced search feature than it would be to find a document in a room full of boxes.

- Documents saved to Receipt Bank are held on the cloud, meaning you can access these for anywhere and at any time. Holding these documents on the cloud is more secure than paper-based storage, as paper documents can be damaged and will degrade with age.

- Uploading documents is really easy, just simply take a picture of your documents and submit them (more information on how to submit can be found below).

- You will save money. Each lost document is an expense that could be claimed back, be that for VAT or an expense-paid out of your personal account. Also, consider what the monetary repercussions could be if you cannot provide a document to HMRC.

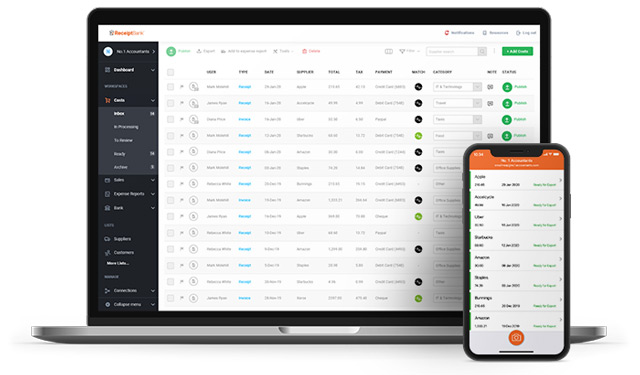

To make it as easy as possible, Receipt Bank allows you to submit these digital copies to the cloud using a variety of submission methods to suit your needs:

- Receipt Bank app: which can be downloaded onto your smartphone from both the Apple Store and Google Play, allows you to take pictures of every receipt on the go

- Submit by Email: the ability to forward on emails with invoices as attachments

- Upload from computer: batch upload scanned or PDF invoices through the online portal

- Invoice Fetch: this submission method allows Receipt Bank to automatically download your recurring bills and invoices from supplier websites

As clients of Sheards, you will have access to this service, as we feel harnessing advances in technology can make your life easier and allow us to work more collaboratively.

Onsite we have a handy webinar which discusses the platform in more detail, which can be found here.

Sign up before 31st August to get this free until 31st March 2021! By signing up with Sheards you will have unlimited users and unlimited submissions*.

See what some of our clients are saying about Receipt Bank:

“I would definitely recommend Receipt Bank. It's saved time and brought our book keeping into the 21st century” Marstons Chicken Shop

“Receipt Bank takes a lot of hassle out of saving and storing scraps of paperwork and receipts for us and knowing it gets stored and is easy to report on for Sheards it's been a real time-saver” Cutting Edge Knives

If you think you could benefit from Receipt Bank, please contact our friendly team today.

*RRP subscription starts at £10 + VAT with only 1 user and a limit on submissions of 50 items per month